On the tail end of the Resilience Conference, and as is often the case with emerging sectors (remember the days of blockchain vs crypto vs. NFTs?), there can be lots of nuance when it comes to what investments fall within the emerging sector and which don’t. As is the case with the increase in interest in resilience, defene, and nat sec tech, I thought I’d share how I think of it, acknowledging it is likely an imperfect framework and would love to hear your thoughts in the comments below.

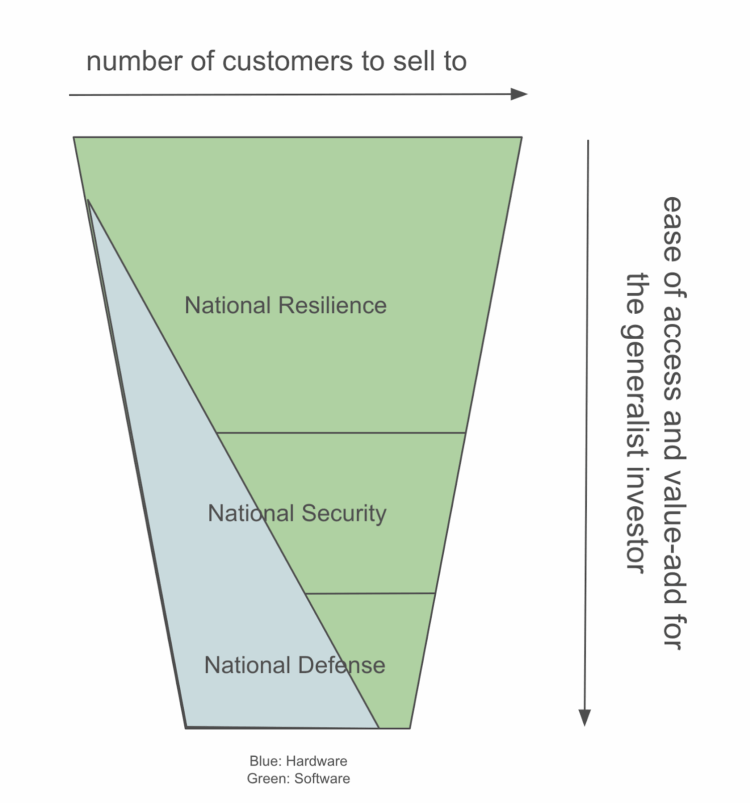

To begin with, I think of it as a stack spectrum (see diagram at the bottom). At the top of the stack spectrum sits ‘National Resilience’, followed by ‘National Security’, followed by ‘Defence’ at the bottom of the stack. Each of these have hardware and software companies within them. “Dual-use” is a term that I think serves as a bridge for companies selling to one of these three, but also having a commercial presence in other common business categories. Some technologies such as ‘robotics’ and ‘materials’ cut across the whole spectrum, but their use and application is what differentiates them. Therefore, the ‘deeper/further-down’ in this vertical stack the company is, the harder I think it is for a generalist investor to invest. This is due to multiple factors, but one critical one is value-add and knowledge of the network of suppliers/partners/customers to help the startup with their go to market strategies.

National Resilience

In some cases, people lump together National Resilience with National Security, and I can understand why, but increasingly it feels like its own distinct category. Companies that fall into this category include generalist cybersecurity companies by definition. It also includes companies that make technologies that protect the safety of and/or increase the redundancy of food supply, energy, semiconductors, local manufacturing etc. You could theoretically include climate-tech in this category, but you’d have to define how you impact a nation state vs. just overall reducing carbon (think flood defenses (hardware) or climate models for defenses (software)).

To add to the definition of National Resilience, Tom Garnett writes: “National Resilience includes commercial organisations that are protecting part of a country e.g. bank for financial crime, cyber security functions within all commercial organisations, and comms teams that are protecting against disinformation in commercial organisations. This also includes Cyber MSSPs and companies that are doing social media content moderation.“

National Security

Companies that fall into this category typically sell into Intel Agencies, Law Enforcement, but also sell into Health services (think biosecurity), regulators/departments (think financial and energy security) all which have something in common in that they manage, use, or create (in the case of camera systems for example) government-owned sensitive data, usually for, as the title implies, for a national security purpose. An example of a type of company/technology that exists in this category in that it protects ‘small n’ national security, are ones that focus on identifying and combating misinformation and disinformation. These companies of course can cut across all three categories, but I put them primarily in this category as they can wreak havoc within a society.

Defence

Companies that fall into this category are focused primarily on national or international military purposes (but not always necessarily for ‘offensive/kinetic’ use) and likely understand the respective governments procurement practices. This category includes technologies like software that tracks assets on the ground, directs logistics and supply chains where needed, etc. A notable venture-backed company here is Helsing. Of course the category also includes technologies like hypersonic propulsion and drone technologies. Primes and Systems Integrators play a key role in supplying technologies for Defence and it is unreasonable to expect that startups can fully replace their role, which include key system integration roles, secrets management, and customer service for the longevity of the deployed technology, but there are for sure many partnership opportunities that will come.

As a generalist investor, I see quicker and larger access to customers at the top of the stack/pyramid (and in cases of dual-use technologies) vs. at the bottom of the stack/pyramid, which specialised investors and primes can capitalise on with their relationships and value-add. On market-sizing, It is harder to make generalisations, but if you use the assumption that more customers x more contracts = larger values, then perhaps there are some conclusions you could draw there.

Carlos Espinal MBE is Managing Partner at Seedcamp, where he has co-lead and shaped one of Europe’s most dynamic seed-stage venture capital firms, and helped lead investments in over 450 startups, including trailblazers like Synthesia, Revolut, Sorare and WISE. Carlos also published the “Fundraising Fieldguide” which offers founders a strategic roadmap for navigating the complexities of fundraising.