Nicholas Nelson brings nearly two decades of experience across defence, intelligence, and venture capital to his work shaping the future of European defence technology. After founding the first venture syndicate focused on European defence startups, he joined MD One as a Partner. He also serves on the faculty at Georgia Tech, is a Senior Fellow for Emerging Technology and Policy at the Center for European Policy Analysis, and is an elected Fellow of the Royal Aeronautical Society. His new fund, Archangel, aims to back defence-first founders across Europe at the earliest stages.

We spoke to Nicholas about the new fund and what Europe needs to do to build out a true defence tech ecosystem. This interview has been edited for length and clarity.

You’re launching a new fund. What’s the focus?

Our new fund is called Archangel. We’ve been quietly building this for a number of months now and have made a number of investments across European defence and dual-use technologies.

Our focus is at the pre-seed, seed, and Series A level—so very early stage. We’re pan-European, with a particular focus on the Baltics, Nordics, and the United Kingdom, and especially on founders who are defence-first. One of the things that really differentiates us is what we’ve learned from U.S. funds. Having spent half my life in the U.S. and half in Europe, I’ve been fortunate to draw on lessons from 20 years in defence.

One of those lessons is clear: among the top-performing U.S. funds—34 of which are either wholly or predominantly dual-use or defence-focused—the best performers share one common trait. In every case, at least one founder has a background in special operations or the intelligence community. That’s not a formal requirement in our view, but it’s not a coincidence either. Real experience matters.

I launched this fund drawing on my own background, alongside the Super Angel team that helped incubate it—operators with successful exits from the Baltic region. Our entire team has deep defence experience, and that’s a core strength. Europe has outstanding technical talent. What it needs now is not just capital, but focused domain expertise and the will to build sovereign capability. That’s what Archangel is about.

Do you think defence is actually getting more attention now?

It’s definitely changed. In 2020 there were serious institutional restrictions holding the sector back. First, I want to push back on a common misconception: that all of this started with Russia’s second invasion of Ukraine. That’s just not true. A lot of newcomers to the ecosystem think that, but they’re missing the broader context.

If you look at the data from 2014 through 2021—the year before the second invasion—you’ll see that defence spending among countries that are members of both NATO and the EU was rising faster, as a percentage, than in the U.S. The spending gap narrowed by nearly 20% over that period. So yes, the second invasion accelerated things, but the trend was already well underway. That long-term shift is what my thesis has been based on for years.

Even back then, and especially after 2022, valuations in the sector were artificially depressed because of capital constraints. That came from several sources. There were historical challenges tied to defence as a sector. There were also ESG-driven investment restrictions—so-called “sin stock” policies—lumping defence in with tobacco, alcohol, and pornography in pension and fund-of-funds strategies. On top of that, the market was fragmented, and defence spending hadn’t yet caught up with strategic needs.

Today, we’re in a different place. The capital is starting to show up, and the talent is finally there. Early-stage funding is growing, but it’s still highly fragmented. Valuations are rising, but often still held down artificially. That leaves a lot more alpha to capture in Europe compared to the much more crowded U.S. market.

And there’s another issue: national champions. In many continental European countries, major defence firms are either wholly or largely government-owned. That creates a structural problem for startups. If you’re a startup or a scale-up, you’re often competing directly with the government for contracts—or you’re stuck as a subcontractor, which doesn’t get you to venture scale. These ESG constraints, historical biases, and market structure issues all combined to hold the sector back.

What does the defence startup landscape look like right now, particularly when it comes to dual-use?

It really depends on how you define dual-use. In the U.S., dual-use might mean a company occasionally sells to commercial customers—even if half or more of their business is actually commercial. It’s not as big of a concern over there.

In Europe, though, we see a lot of what I call “defence washing.” That’s when a company sells something once to a defence ministry or department and suddenly claims to be dual-use. In practice, that’s not how it works. That’s why I draw a clear line between “dual-use” and “defence-first.”

By “defence-first,” I mean companies that generate more than 50% of their current or projected revenue from defence sources—either directly from ministries of defence or from major aerospace and defence primes. In my experience, those are the companies that outperform.

When startups try to be dual-use from day one—or start commercial and try to pivot into defence later—they usually struggle. You’re building two go-to-market strategies, and often two versions of a product. You end up doing neither well. In Europe especially, dual-use often becomes a fig leaf for indecision. Founders building for defence from the outset not only deserve better—they tend to build better companies.

So you’re saying defence startups should just be defence startups—full stop?

Exactly. It sounds appealing to think a company building kamikaze drones could someday pivot to agricultural imaging, turning swords into ploughshares. But that pivot is almost impossible. The tech requirements, users, and integration challenges are completely different.

On paper, dual-use sounds logical. Let’s back tech that serves both markets: AI, autonomy, materials science, space. That’s all great. But in Europe right now, dual-use has become a branding trend more than a serious strategy. We’re at the start of a hype cycle, and too many people are jumping on the defence bandwagon without understanding the sector.

Startups are being encouraged to build for commercial markets first and treat defence as a hedge. So you end up with a B2B supply chain platform, and someone suggests, “Maybe you can sell this to NATO.” That’s a red flag. Defence isn’t an add-on. It’s a standalone domain with its own users, needs, and constraints.

What happens when a startup fails to break into defence?

It’s rarely because the tech wasn’t good. It’s usually because the founders didn’t spend the time to understand how the domain works. You need early access to end users. You need to know the procurement process. You need to understand integration timelines.

It comes down to warfighter fit. The people on the front lines are your users. If your startup fails to connect with them, that’s the problem—not your tech stack. And when investors or buyers pass over defence-first companies in favour of trendy dual-use startups, it’s not risk management—it’s cowardice.

Trying to force companies into dual-use leads to poor outcomes for investors, founders, and especially the end users in defence.

What’s the one thing generalist VCs don’t understand about defence?

At the core, it comes down to domain experience. You wouldn’t back a biotech startup without someone at the fund who has a PhD in life sciences. You wouldn’t fund a quantum company without someone who truly understands quantum. Defence is the same. You can read about it, you can be an enthusiast—but if no one at your fund has lived it, you’re going to struggle.

Defence is an incredibly complex and insular ecosystem. It’s getting better, but without lived experience and the right network, it’s very hard to operate effectively. That’s why I point to the top U.S. defence VCs. They’re now on their third or fourth fund, and every one of them has at least one founder with a background in special operations or intelligence. That’s not a coincidence. It’s essential.

So what kind of investors do early-stage defence startups need?

Founders should look for investors who’ve built things under pressure. The best investors I know didn’t set out to be VCs. They led teams. They operated in high-stakes or deployed environments where failure wasn’t really an option. And at some point, they realised the best way to keep pushing the frontier forward was to back the next generation of builders.

That kind of investor isn’t just bringing capital—they’re bringing credibility and practical support. As companies scale, it becomes more about who can lead the next funding round. But at the early stage, you need someone who adds real value. Whether it’s me or someone else, find someone who knows the sector, understands what you’re building, and can help you grow.

How should founders approach investor selection?

Do your due diligence. Don’t just be grateful someone’s writing a cheque. Ask hard questions: What’s your value add in defence? Do you invest in defence? Who in your portfolio is defence-focused?

A mentor of mine used to say, “Don’t tell me your thesis—show me your portfolio.” That still holds true. Look at who they’ve backed. Talk to those founders. See whether the investor actually helped them or just wrote a cheque. Don’t accept hype. Cut through the noise and find the people who really know what they’re doing. The power dynamic in venture is too often skewed, especially at the early stage—but it shouldn’t be. Founders need to take control and find real partners.

What’s the best way for a defence startup to get noticed by investors and governments?

First, build the right team. That’s the biggest factor at the early stage. If the founders have real experience—military service, defence ministry work, or previous defence startups—that’s a signal. Second, do serious customer discovery. Don’t assume you know what defence needs because you read a whitepaper. Talk to warfighters. Understand the mission. If you’re solving a real problem, you’ll stand out. Third, when talking to investors, make sure they’re truly defence-aligned. Ask them who in their portfolio is defence. Talk to those founders. The power dynamic needs to shift—founders should vet VCs too.

In closing—what gaps do you see in the defence tech space right now? Are there specific technology or pricing areas where startups should be focusing?

Absolutely. First off, the volume of deal flow has picked up sharply—especially in the last six months. But the problem is, a lot of founders are skating to where the puck is, not where it’s going. The world doesn’t need another FPV drone or a new drone-swarming technique. What’s needed are key enablers—capabilities that support or unlock broader systems, depending on where you sit in the value chain.

One big issue is pricing. A lot of American defence tech doesn’t translate well into the European context because the cost structure is so different. In the U.S., attritable systems—those you’re expected to lose—can cost several times more than what European militaries can justify spending. So we need to figure out how to return affordable mass to the battlefield. That includes air, but also land, sea, and space.

So where are the biggest capability gaps?

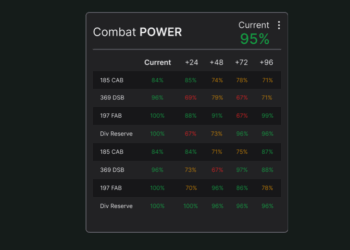

One clear gap is in resilient, secure, active communications across Europe. Think of C5ISR—command, control, communications, computers, cyber, intelligence, surveillance, and reconnaissance. Situational awareness is what defines modern conflict. Getting that right isn’t just about winning battles—it’s about deterrence.

Beyond that, we need scalable low-cost munitions, smart systems that can be mass-produced, and hybrid approaches to swarm tech. These areas aren’t flashy, but they’re critical. Done right, they improve deterrence without escalating aggression. This isn’t about warmongering—it’s about giving democracies the tools to defend themselves.

What advice would you give to founders building in this space?

Founders—and investors—should ask themselves two questions: Is this making my society or my warfighter more resilient? Or is it making the warfighter more lethal? That’s it. That’s the test.

Defence tech isn’t always about weapons. It’s about enabling the broader ecosystem—from identifying threats, to responding to them, to closing the loop and learning from it. Founders need to be honest about whether they’re solving a real, unmet problem—or just building what everyone else is already building.

I’ve met plenty of smart, passionate founders who are working on problems that are already saturated. Right now, there are over 500 drone companies active in Europe. If you’re starting one today, you’re too late. Find a hard problem. Do the customer discovery. Take big swings where no one else is swinging. That’s how you make a real impact.