Venture capitalists are pouring cash into defence technology across NATO, according to Dealroom’s The State of Defence Tech 2025 report. Startups in member NATO states have raised $9.1 billion so far in 2025, putting the sector on track for around $13.7 billion by year’s end, compared with $6.5 billion in 2024.

While the US has constituted the lion’s share of defence tech VC funding among NATO allies with 85% since 2019, Dealroom’s report — produced in conjunction with Resilience Media and presented at its Resilience Conference today — notes that Europe has begun to carve out its own space. Investment has roughly doubled in the past year, with a record $1.5 billion raised so far in 2025 and a projected $2.3 billion by year’s end versus $1 billion last year.

This funding spike can be attributed to a handful of mega deals, including the €600 million ($700 million) Germany-based AI defence tech startup Helsing has raised, as well as smaller — but no less significant — deals such as Tekever’s €70 million ($82 million) round in Portugal.

The bigger picture, of course, is the geopolitical backdrop. Russia’s invasion of Ukraine in February 2022 jolted European governments and investors, prompting a wholesale rethink of security and defence priorities. That urgency has filtered into venture capital, with dual-use technologies once seen as niche now attracting mainstream attention.

Some of the most striking data points to emerge from the report underscore Europe’s shifting priorities — perhaps most notably, the prominence of defence tech relative to other sectors.

Fastest-growing sector

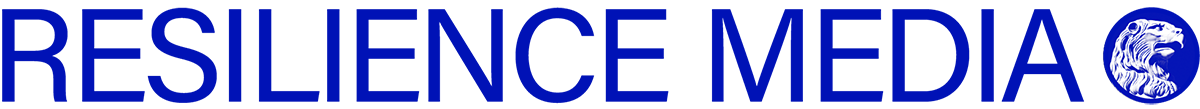

Defence has become the fastest-growing category in European venture capital, although it is coming from a small start. Before 2020, it accounted for a marginal 1% of total funding, compared to 4% today. And in the European Union, the proportion is even higher at 6.2%.

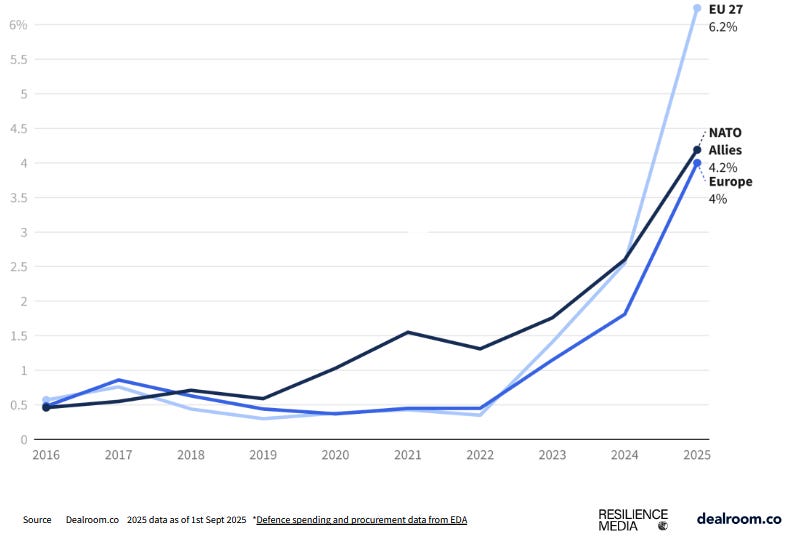

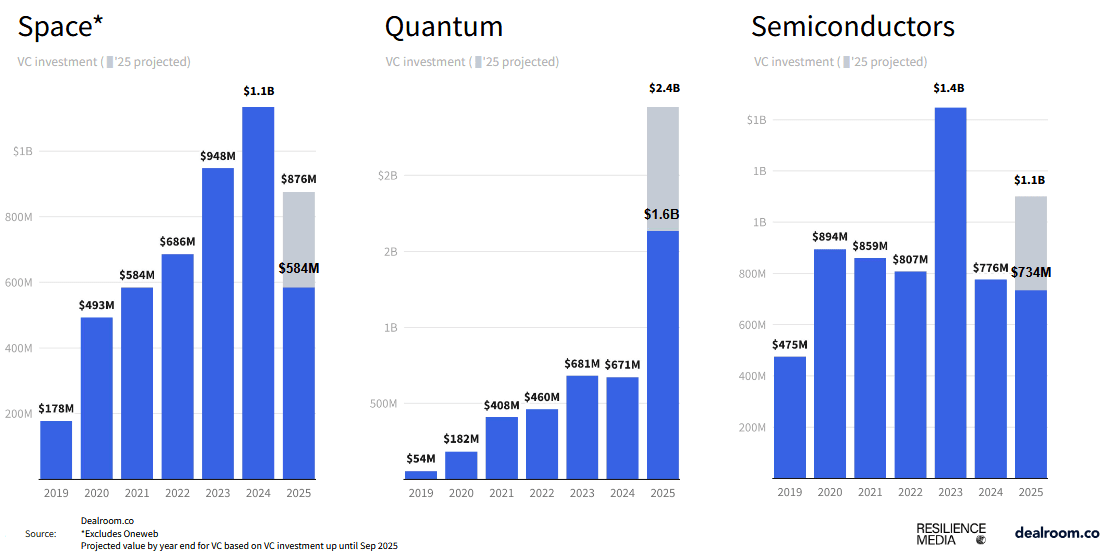

For context, the broader Defence, Security and Resilience (DSR) category — which covers dual-use and strategic technologies such as quantum, semiconductors and space — is projected to reach $4.7 billion in funding this year, a 32% increase on 2024.

However, the defence-specific segment, focused on military-first companies, is the real outlier: projected to grow 132% year-on-year, it has become Europe’s fastest-rising venture vertical. The report doesn’t provide the same cross-sector comparison for the US or the NATO alliance as a whole, so it’s unclear whether this pattern is unique to Europe.

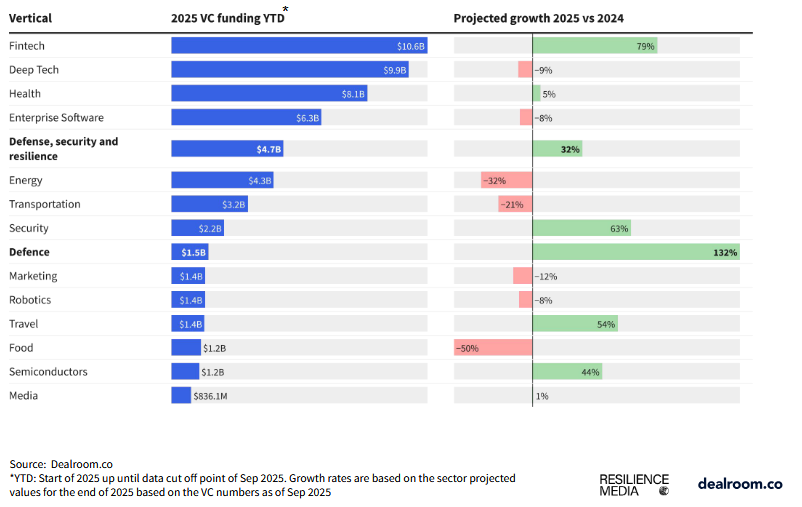

Digging down into the sector segments shows how this growth is playing out: AI-focused defence startups have attracted the lion’s share of capital, amounting to $929 million so far this year, and $2.1 billion since 2019. This has largely been driven by Helsing, which in addition to its bumper €600 million raise this year, had also secured €450 million in 2024.

Elsewhere, robotics and autonomous systems have drawn the largest number of individual deals, with 30 rounds in 2025 alone and 138 since 2019, most of them concentrated in UAVs and drones.

Looking beyond military-first startups, investment is also accelerating in adjacent resilience technologies.

Quantum has surged to the front, with European firms drawing in well over a billion dollars this year, while sectors like space and semiconductors are steadily building momentum. Taken together, these dual-use areas point to a widening definition of security, where cutting-edge science and infrastructure play as much of a role as traditional defence systems.

Investors’ view

The investor base for European defence tech has also been expanding, with participation up nearly fourfold since 2019.

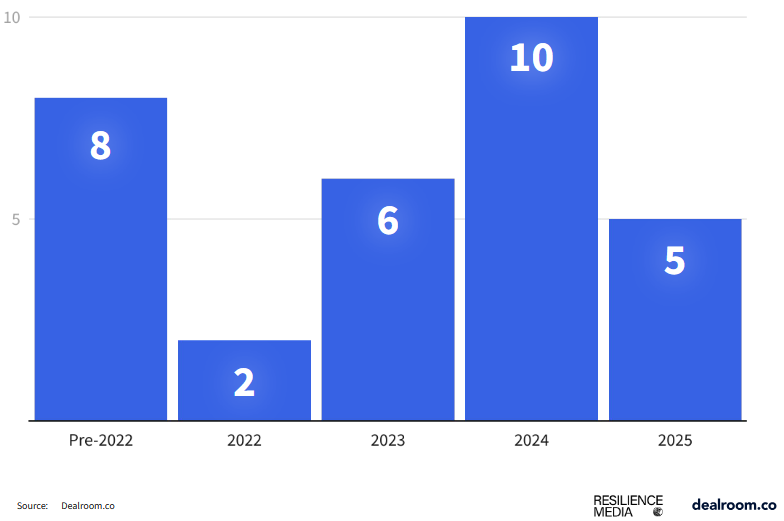

What was once dominated by a handful of generalists is now a growing field of specialist funds, many of which launched in the past three years — from six in 2023 to ten in 2024 and five more already this year, on top of the eight that existed pre-2022.

These include Dutch VC firm Keen, which recently raised a €125 million ($146 million) defence tech fund. Adding to that momentum, NATO also launched its Innovation Fund in 2023, a €1 billion ($1.2 billion) vehicle dedicated to backing defence, security and resilience technologies across the alliance.

These new specialist funds have already participated in over a third of all defence rounds in 2025, nearly double their share last year. Most are focused on early-stage bets, but larger late-stage cheques are increasingly being filled by US investors, who now account for 40–50% of European defence funding.

Aside from more traditional institutional funds, we’re also starting to see corporate-backed mega-funds enter the field. Most notably, Deutsche Telekom and Porsche SE are reportedly preparing a €500 million ($583 million) venture fund to be managed by Deutsche Telekom Capital Partners (DTCP), with a mandate to back European defence technology firms.

Taken together, the surge of capital and the rise of specialist funds suggest that defence tech is no longer a fringe category in Europe. With geopolitical tensions unlikely to ease and NATO doubling down on military preparedness, the sector looks set to remain one of the most dynamic — and strategically important — frontiers in European venture capital.