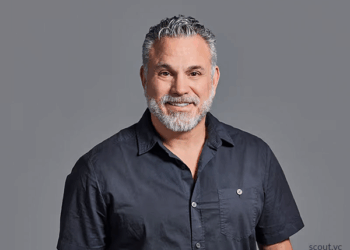

Jonatan Luther-Bergquist is a partner at inflection.xyz, a venture firm based in Munich focused on early-stage investments across sectors like semiconductors, space, and Web3. He has a background in blockchain architecture and IT strategy, with prior roles at BCG Platinion and Datarella. A founding member of the European Blockchain Association, he combines technical expertise with a strong interest in decentralized systems, privacy, and infrastructure. Luther-Bergquist holds a master’s degree from Uppsala University and completed exchange studies at TUM and EPFL.

As part of his work at inflection.xyz, he has produced a complete and fascinating report on the state of defense in Europe. In it, he encourages European founders to see defense not as frightening or a non-starter but instead as an important investment channel.

“New Defense is not only a market trend, it is a strategic imperative for European sovereignty, peace, and prosperity,” he wrote. “By building the technological and industrial foundations of a resilient defense ecosystem, Europe can ensure it is not only protected but also prepared to lead in an increasingly contested and multi-polar world.”

We sat down with Luther-Bergquist to explore the impetus behind this report.

RM: Jonatan, you’ve just published an extensive report called Europe’s New Defense. Can you tell us about the genesis of this, why did you decide to produce the report?

JLB: It feels like European VCs have been making up their minds this last 18 months regarding defense tech and whether or not it’s an investable category, both from a moral standpoint (I think now 90% agree with the general sentiment that we need to spend more on defense and prioritize innovation), but also from a venture perspective.

So we set out to answer the question: What types of companies will produce really big outcomes in Europe, if any? What does the market structure look like and how should startups navigate this pretty complex space? Regulations, procurement laws, prime incumbents plus a generally secretive industry makes defense tech startups 10x harder than in civilian markets, so potential outcomes need to be much larger to motivate the risk.

RM: And what are your main findings from this research?

JLB: We haven’t produced a playbook, but rather try to present mostly facts and background information, alongside our own conclusion. In short, we think three types of companies have the potential to become really valuable.

First, vertically integrated, prime-like companies such as Anduril, with a more software-centric approach to building. They’ll sell systems and capabilities to the government directly. Second, there will be some hard-to-make “components” that weren’t required or couldn’t have been built a few years ago. E.g., specialized on-board sensing, compute for drones or underwater autonomy software. These companies will be able to sell to multiple primes and therefore benefit from economies of scale and potentially network effects.

The third category of companies are deep tech, long-term dual use companies who build something fundamentally new, completely changing the game. This could be a new type of propulsion system, material or sensing equipment. The first customer might be military, but down the line there’s no reason why they couldn’t go into civilian markets. There probably won’t be hundreds of European defense tech unicorns created in the next 10 years, but more one or two orders of magnitude less.

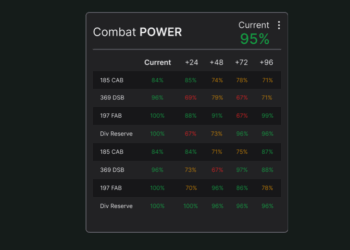

RM: You have some great data in there, again what are the headline numbers?

JLB: €1.3T new investments in infrastructure and defense announced on an EU level and in Germany. The largest VC funding amounts for defense tech in European history, and it keeps growing. The scary numbers: Non-Ukraine Europe doesn’t come close to Russian defense spending or number of battalions.

RM: What would you like people to take away from this research?

JLB: European Defense Tech is investable, but it’s difficult. Massive outcomes are possible because it’s a very outdated industry, in a market environment with long term support. The rate of innovation at the front can not be matched by the traditional primes, and honestly also not by the procurement cycles of our governments.

RM: Were there any surprises that came out of the work?

JLB: The realization of how big the market actually is. Even just 2-5% of GDP of most European countries is a pretty large number.

RM: What next? Will you do more, or do this again?

JLB: We will continue to publish these deep dives into various topics around our thesis, sovereign compute. Even within defense there are so many important topics we could tackle, i.e., procurement reform, integration and logistics.

RM: How do you hope the research will impact the ecosystem?

JLB: I hope entrepreneurs aim big, and that VCs set the bar high. We need more success stories, not just more investment. I would also hope that more technical talent is inspired to take on these challenges.

You can read the full report here.